-

Products & Solutions

-

Agricultural Machinery

back to Overview

-

Tractors

-

Fendt 1100 Vario MT

from 376 kW / 511 hp to 495 kW / 673 hp

from 376 kW / 511 hp to 495 kW / 673 hp -

Fendt 1000 Vario

Fendt 1000 Variofrom 291 kW / 396 hp to 380 kW / 517 hp

Fendt 1000 Variofrom 291 kW / 396 hp to 380 kW / 517 hp -

Fendt 900 Vario MT

Fendt 900 Vario MTfrom 279 kW / 380 hp to 317 kW / 431 hp

Fendt 900 Vario MTfrom 279 kW / 380 hp to 317 kW / 431 hp -

Fendt 900 Vario

Fendt 900 Variofrom 217 kW / 296 hp to 305 kW / 415 hp

Fendt 900 Variofrom 217 kW / 296 hp to 305 kW / 415 hp -

Fendt 700 Vario Gen7

Fendt 700 Vario Gen7from 149 KW / 203 hp to 223 kW / 303 hp

Fendt 700 Vario Gen7from 149 KW / 203 hp to 223 kW / 303 hp -

Fendt 700 Vario Gen6

Fendt 700 Vario Gen6from 106 kW / 144 hp to 174 kW / 237 hp

Fendt 700 Vario Gen6from 106 kW / 144 hp to 174 kW / 237 hp -

Fendt 600 Vario

Fendt 600 Variofrom 110 kW / 149 hp to 154 kW / 224 hp

Fendt 600 Variofrom 110 kW / 149 hp to 154 kW / 224 hp -

Fendt 500 Vario

Fendt 500 Variofrom 91 kW / 124 hp to 120 kW / 163 hp

Fendt 500 Variofrom 91 kW / 124 hp to 120 kW / 163 hp -

Fendt 300 Vario

Fendt 300 Variofrom 83 kW / 113 hp to 104 kW / 142 hp

Fendt 300 Variofrom 83 kW / 113 hp to 104 kW / 142 hp -

Fendt 200 Vario

Fendt 200 Variofrom 58 kW / 79 hp to 91 kW / 124 hp

Fendt 200 Variofrom 58 kW / 79 hp to 91 kW / 124 hp -

Fendt 200 VFP Vario

Fendt 200 V/F/P Variofrom 58 kW / 79 hp to 91 kW / 124 hp

Fendt 200 V/F/P Variofrom 58 kW / 79 hp to 91 kW / 124 hp -

Fendt e100 Vario

Fendt e100 V Vario55 kW / 75 hp

Fendt e100 V Vario55 kW / 75 hp

-

Fendt 1100 Vario MT

-

Telehandler

-

Fendt Cargo T955

Fendt Cargo T955123 kW / 171 hp

Fendt Cargo T955123 kW / 171 hp -

Fendt Cargo T740

Fendt Cargo T740100 kW / 136 hp

Fendt Cargo T740100 kW / 136 hp

Combines-

Fendt IDEAL

Fendt IDEALfrom 336 kW / 451 hp to 581 kW / 790 hp

Fendt IDEALfrom 336 kW / 451 hp to 581 kW / 790 hp -

Fendt C-Series

Fendt C-Seriefrom 225 kW / 306 hp to 265 kW / 360 hp

Fendt C-Seriefrom 225 kW / 306 hp to 265 kW / 360 hp -

Fendt L-Series

Fendt L-Seriefrom 192 kW / 260 hp to 225 kW / 306 hp

Fendt L-Seriefrom 192 kW / 260 hp to 225 kW / 306 hp -

Fendt CORUS 500

Fendt CORUS 500from 136 kW / 185 hp to 192 kW / 260 hp

Fendt CORUS 500from 136 kW / 185 hp to 192 kW / 260 hp

-

Fendt Cargo T955

-

Mowers

-

Fendt Slicer disc mowers

Fendt Slicer disc mowers

Fendt Slicer disc mowers -

Fendt Slicer front mounted mower

Fendt Slicer front mounted mower

Fendt Slicer front mounted mower -

Rear mounted Fendt Slicer

Rear mounted Fendt Slicer

Rear mounted Fendt Slicer -

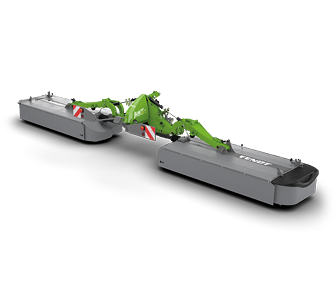

Fendt Slicer mower combinations

Fendt Slicer mower combinations

Fendt Slicer mower combinations -

Fendt Cutter

Fendt Cutter

Fendt Cutter

Forage wagons-

Fendt Tigo XR/VR/PR

Fendt Tigo

Fendt Tigo

XR/VR/PR -

Fendt Tigo MS/MR/MR Profi

Fendt Tigo

Fendt Tigo

MS/MR/MR Profi

-

Fendt Slicer disc mowers

-

Balers

-

Square Balers

Fendt Square balers

Fendt Square balers -

Rotana F

Fendt Rotana F

Fendt Rotana F -

Rotana V

Fendt Rotana V

Fendt Rotana V -

Rollector

Fendt Rollector

Fendt Rollector

-

Square Balers

-

- Areas of Application

- Smart Farming

- Original accessories & Technologies

-

Agricultural Machinery

- Net sales of $11.7 billion, down 19.1%, in 2024

- Full year reported operating margin of (1.0)% and adjusted operating margin(1) of 8.9%

- 2024 full year reported earnings per share of $(5.69) and adjusted earnings per share(1) of $7.50

- Reaffirms 2025 Outlook – Net sales of approximately $9.6 billion and earnings per share of $4.00 - $4.50

Net sales for the full year of 2024 were approximately $11.7 billion, which is a decrease of 19.1% compared to 2023. For the full year, reported netloss was $(5.69) per share, which includes the loss on sale of the Grain & Protein business, impairment charges and restructuring and business optimization expenses, and adjusted net income(1) was $7.50 per share. These results compare to reported net income of $15.63 per share and adjusted net income(1) of $15.55 per share in 2023. Excluding unfavorable currency translation impacts of 0.6%, net sales for the full year decreased 18.5% compared to 2023.

"AGCO delivered strong fourth quarter results with an adjusted operating margin of 9.9%, even with challenging market dynamics and aggressive production cuts," said Eric Hansotia, AGCO's Chairman, President and Chief Executive Officer. "We cut our production hours 33% in the fourth quarter and ended the year with lower company and dealer inventory compared to 2023. Our full-year adjusted operating margin performance of 8.9% is by far our best performance in an industry downturn. The strong performance in 2024, driven by our three high-margin growth levers and intense focus on cost controls, underscores the ongoing structural transformation at AGCO as we deliver more resilient and higher earnings across the cycle."

Hansotia continued, "In 2025, we will continue to execute our Farmer-First strategy strengthened by the portfolio moves and aggressive cost control actions, including our ongoing restructuring program. We expect these efforts to dampen the impact of further weakening industry demand, helping deliver adjusted operating margins well above levels achieved during prior industry troughs. We will continue our investments in premium technology, smart farming solutions and enhanced digital capabilities to support our Farmer-First strategy to better position the company for success when the industry recovers while helping to sustainably feed the world."

Highlights

- Reported fourth-quarter regional sales results(2): Europe/Middle East ("EME") (16.7)%, North America (38.7)%, South America (31.6)%, Asia/Pacific/Africa ("APA") (26.2)%

- Constant currency fourth-quarter regional sales results(1)(2)(3): EME (15.8)%, North America (37.7)%, South America (22.4)%, APA (26.3)%

- Fourth quarter regional operating margin performance: EME 14.4%, North America 0.7%, South America 10.8%, APA 3.0%

- Full-year reported operating margins and adjusted operating margins(1) were (1.0)% and 8.9% respectively, in 2024 compared to 11.8% and 12.0% in 2023

(1) See reconciliation of non-GAAP measures in appendix.

(2) As compared to fourth quarter 2023.

(3) Excludes currency translation impact.

Market Update

Industry Unit Retail Sales

| Tractors | Combines | |

| Year ended December 31, 2024 | Change from Prior Year | Change from Prior Year |

| North America(4) | (13) % | (22) % |

| Brazil(5) | (4) % | (33) % |

| Western Europe(5) | (6) % | (32) % |

(4) Excludes compact tractors.

(5) Based on Company estimates.

Hansotia concluded, "Global agricultural markets face both challenges and opportunities. U.S. net cash farm income remains strong for livestockfocused farms, while crop-focused farms are experiencing declines due to fluctuating prices for corn, soybeans, and wheat and relatively elevated input costs. Brazil's record soybean production and delayed corn planting highlight both growth potential and risks. Geopolitical instability, coupled with weather-related disruptions in major producing regions like Russia and Ukraine, continue to impact global wheat supplies, adding uncertainty to the market. Demand for new equipment has softened further in most global markets, particularly as lower farm income persists for crop producers. We continue to expect increased adoption of precision technology, but challenging farm economics are resulting in weak global industry demand across most equipment categories."

North American industry retail tractor sales decreased 13% during 2024 compared to the previous year. Sales declines were relatively consistent across the horsepower categories with higher horsepower categories declining more in recent months. Combine unit sales were down 22% in 2024 compared to 2023. Lower projected farm income and a refreshed fleet is expected to pressure industry demand in 2025, resulting in weaker North American industry sales compared to 2024, particularly in larger equipment.

Brazil industry retail tractor sales decreased 4% during 2024 compared to the previous year. Farm acreage in Brazil increased only modestly in 2024 after five years of more significant growth. Lower commodity prices, rising farmer debt, and reduced demand from China created caution among Brazilian farmers. Industry demand in Brazil is expected to remain flat in 2025, due to mixed market dynamics.

In Western Europe, industry retail tractor sales decreased 6% during 2024 compared to the previous year with more significant declines in Scandinavia, the United Kingdom and Italy. Industry demand is expected to remain soft in 2025 as lower income levels pressure demand from arable farmers, while healthy demand from dairy and livestock producers is expected to mitigate some of the decline.

Regional Results

AGCO Regional Net Sales (in millions)

Three Months Ended December 31 | 2024(7) | 2023 | % change from 2023 | % change from 2023 due to currency translation(6) | % change from 2023 due to acquisition of a business(6) | % change excluding currency translation and acquisition of a business |

| North America | $ 546.8 | $ 891.7 | (38.7) % | (1.0) % | 0.9 % | (38.6) % |

| South America | 282.0 | 412.9 | (31.6) % | (9.2) % | 1.2 % | (23.6) % |

| EME | 1,882.8 | 2,259.0 | (16.7) % | (0.9) % | 1.4 % | (17.2) % |

| APA | 175.7 | 238.0 | (26.2) % | 0.1 % | 2.1 % | (28.4) % |

| Total | $ 2,887.3 | $ 3,800.7 | (24.0) % | (1.8) % | 1.3 % | (23.5) % |

Years Ended December 31, | 2024(7) | 2023 | % change from 2023 | % change from 2023 due to currency translation(6) | % change from 2023 due to acquisition of a business(6) | % change excluding currency translation and acquisition of a business |

| North America | $ 2,850.3 | $ 3,752.7 | (24.0) % | (0.3) % | 1.0 % | (24.7) % |

| South America | 1,315.9 | 2,234.2 | (41.1) % | (3.5) % | 1.0 % | (38.6) % |

| EME | 6,812.9 | 7,540.5 | (9.6) % | 0.1 % | 1.2 % | (10.9) % |

| APA | 682.8 | 885.0 | (22.8) % | (0.4) % | 1.6 % | (24.0) % |

| Total | $ 11,661.9 | $ 14,412.4 | (19.1) % | (0.6) % | 1.2 % | (19.7) % |

(6) See footnotes for additional disclosures.

(7) Note: The regional net sales for the three months ended December 31, 2024 and year ended December 31, 2024 include the results of the Company's Grain & Protein business which was divested on November 1, 2024.

North America

North American net sales decreased 24.7% for the full year of 2024 compared to 2023, excluding the impact of unfavorable currency translation and favorable impact of an acquisition. Softer industry sales and lower end-market demand contributed to lower sales. The most significant sales declines occurred in the high-horsepower and mid-range tractor categories, as well as hay tools. Income from operations for the full year of 2024 decreased $283.5 million compared to 2023 and operating margins were 6.2%. The decrease resulted from lower sales and production volumes, as well as increased discounts.

South America

Net sales in AGCO's South American region decreased 38.6% for the full year of 2024 compared to 2023, excluding the impact of unfavorable currency translation and favorable impact of an acquisition. Softer industry retail sales and under-production of retail demand drove most of the decrease. Lower sales of high-horsepower tractors, combines and planters accounted for most of the decline. Income from operations for the full year of 2024 decreased by $282.0 million compared to 2023. This decrease was primarily a result of lower sales and production volumes as well as negative pricing.

Europe/Middle East

Europe/Middle East region net sales decreased 10.9% for the full year of 2024 compared to 2023, excluding the impact of favorable currency translation and favorable impact of an acquisition. Lower sales across most of the European markets were partially offset by growth in Spain and Turkey. Declines were largest in mid-range and high-horsepower tractors and hay equipment. Income from operations decreased $174.9 million for the full year of 2024 compared to 2023. This decrease was primarily a result of lower sales and production volumes.

Asia/Pacific/Africa

Net sales in the Asia/Pacific/Africa region decreased 24.0%, excluding the impact of unfavorable currency translation and favorable impact of an acquisition, during the full year of 2024 compared to 2023 due to weaker end market demand and lower production volumes. Lower sales in China, Australia and Africa drove most of the decline. Income from operations decreased $44.6 million for the full year of 2024 compared to 2023 primarily due to lower sales volumes.

Outlook

As previously announced, AGCO's net sales for 2025 are expected to be approximately $9.6 billion, reflecting lower sales volumes, relatively flat pricing as well as unfavorable foreign currency translation. Adjusted operating margins are projected to be approximately 7% - 7.5%, reflecting the impact of lower sales, lower production volumes, increased cost controls and moderately lower investments in engineering. Based on these assumptions, 2025 earnings per share are targeted at approximately $4.00 - $4.50.